by Dale T. McKinley

Hundreds of thousands (potentially millions) of poor and destitute ex-workers and their families have lost most of their confidence in the integrity and ‘reputation’ of the Financial Sector Conduct Authority and its Treasury parent, to perform their functions in a just, equitable and efficient manner, to serve their interests.

No one seems quite certain who wrote the poem, but it is widely thought to have been penned in England during the late 18th/early 19th centuries as a protest against the enclosures of common ground. Whatever the case in the 200 or so years since, its universal relevance has certainly not diminished one iota.

They hang the man and flog the woman

That steal the goose from off the common,

But let the greater villain loose

That steals the common from the goose.

The law demands that we atone

When we take things we do not own

But leaves the lords and ladies fine

Who take things that are yours and mine.

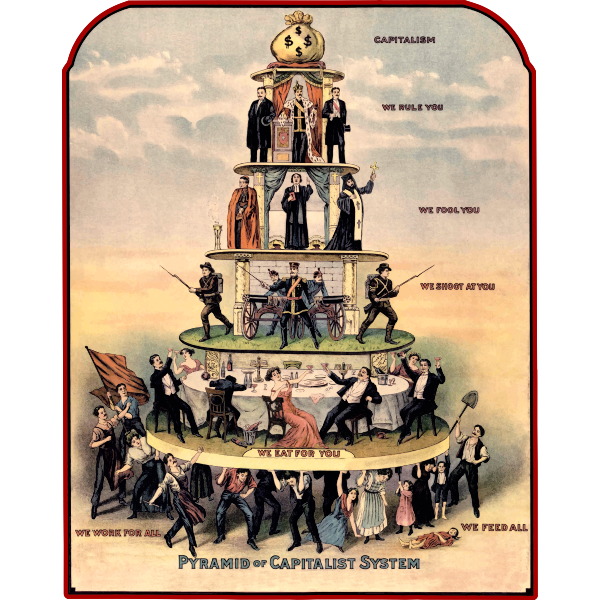

When specifically applied to contemporary South Africa though, there is a double applicability of a special type. Foundationally, it speaks to the historic and continued structural inequalities of class and gender (both of which are intricately linked to race) associated with the general application of the law. And, it shows up the very real, but still largely hidden contradictions inherent in all the recent talk and writing centred on the need to uphold and restore the “rule of law”.

Much of that discourse is related to the significant social and economic damage caused, over the last decade or so in particular, by the illegal activities of and shady relationships between some of those in the state and the private sector. At the heart of it all has been, and remains, the Treasury.

There is no denying that the outrageously opportunistic, manipulative and greed-soaked activities of the Zupta crew hobbled some of the administrative, technical and managerial capacity within the Treasury. Yet, the ways in which this reality has (for the most part) been presented, discussed and understood paints a lopsided picture.

It is one of a Treasury, save for the various interlopers with bad intent, standing tall in defence of and with respect for the law, holding the line against unaccountability and lack of transparency, and in the process waging a righteous battle for the common person against the villainous onslaught.

But there is another side to the Treasury coin, one that existed before and continues to exist after the Zupta era.

It is on this terrain where the Treasury deals with the really big bully boys of our contemporary social-economic system: Large financial institutions.

And it is here where the general approach and more specific application of the law appear to consistently serve those who benefit from varying degrees of secrecy and unaccountability, including the interests of those who play fast and loose with significant portions of the hard-earned provident and pension funds of ex-workers.

For us to get a sense of the size, assets, monopoly character and influence of the financial services sector, let’s take a quick look at some revealing figures and analysis from the 2017 First Report on the Transformation of the Financial Sector, produced by Parliament’s Standing Committee on Finance and Portfolio Committee on Trade and Industry.

It controls about R12-trillion in assets which is four times the country’s GDP;

Its contribution to the GDP has risen from 15% in 1994 to 22% in 2017 (which is now greater than the 17.2% contribution of government);

The sector is a direct funder of government and state-owned entities, through loans and the purchasing of bonds, and then also indirectly through taxes (last year it contributed around 30% of total corporate income tax collected); and

The top 10 asset managers (all largely concentrated in those financial service “provider” group who also administer pension and provident funds) hold approximately 70% of assets under management and 77% of the market while the Top Five hold more than 50% of assets.

Given this size and influence, it should not come as too much of a surprise that the dominant view of those in charge of the nation’s Treasury is arguably that because the health of the country’s economy is so dependent on the success of the financial sector, such success must be protected; even if this involves the financial “lords and ladies” confiscating significant financial assets of the “commoners” by breaking or finding opportunistic loopholes in the law.

There is no better example than the cancellations of the registrations of thousands of pension and provident funds carried out by Liberty and numerous other fund administrators, with the active support of the Financial Sector Conduct Authority (FCSA — formerly the Financial Sector Board).

Much has been written and aired about these cancellations. This includes the recent majority decision of the Constitutional Court that dismissed ex-Deputy Registrar of Pension Funds Rosemary Hunter’s application for an order that the FSCA conduct a further and much deeper investigation into the cancellations.

Regardless, the truth is that Liberty asked the registrar to cancel the registrations of thousands of funds, either knowing, or not caring to check whether, they still had assets and liabilities. One of these funds was the Bivec Pension Fund which had assets of nearly R20-million when its registration was cancelled despite protests by the employer of its members.

Liberty’s conduct in getting the Bivec fund de-registered was like a debtor knee-capping its creditor so that the creditor cannot pursue it to recover the money due to it. Despite Liberty’s court application in November last year for an order setting aside the cancellation of the Bivec Fund’s registration, along with many others, so that assets could be dealt with properly, the bottom line is that Liberty’s earlier conduct was met with an instructive silence by Treasury and the FSCA, let alone punished.

Similarly, Alexander Forbes got away with its unlawful conduct (circa 2006) in creaming off as “secret profits” some of the interest earned by its pension fund clients on their bank deposits.

While the company concluded an agreement with the registrar of pension funds to pay the 1,825 affected funds at least some of these secret profits (with an aggregate value of hundreds of millions), the registrar, at their request, cancelled the registrations of dozens of funds on their books.

This was done on the basis of patently false statements by staff that the funds had no assets or liabilities when they hadn’t even paid them the money they had undertaken to pay.

It is this laissez faire approach to the conduct of large financial institutions that shines bright in Treasury’s warm welcome, penned by Ismail Momoniat, of the majority decision of the Constitutional Court ruling in the Hunter case.

That case and the FCSA investigations it prompted (limited to fewer than 25% of the 4,600 cancellations) disclosed that at least 5% of them had been “erroneous” and that administrators had been unlawfully holding on to (and, no doubt, profiting from) hundreds of millions of rands of peoples’ retirement savings.

And yet, Treasury chooses to argue that any further investigation would be “fruitless”.

This is indicative of a mindset that sees the financial assets of workers/poor people (access to which can be a life-and-death matter) as not being deserving of the same special and thorough attention that Treasury consistently demands when it comes to the State Capture mess.

The fact is that we don’t know how much more money is being unlawfully held in the same way as with the portion of identified funds.

Neither do we know how many more beneficiaries and families will continue to be deprived of their money for so long as the rest of the cancellations are not properly investigated and resulting prejudice is addressed.

Such lack of information alongside a dearth of accountability and transparency — the very things that provide the foundational ground for both de jure and de facto illegality — is however, clearly not of great importance to the Treasury; at least not when it involves the high and mighty that sit on the financial services throne.

And yet we are asked to accept at face value the claim made by the Treasury that both parent and child (that is, Treasury and the FCSA) have upheld their “primary objective”, which is “to ensure that [they] always acts in the interests of the customer, including members of retirement funds”.

Not only that, but also to accept that they have pursued this objective with an “integrity” that has ensured “that financial customers are confident that the financial sector is serving their best interests and delivering proper outcomes”.

If this is the case then why did both show such vigorous and conflictual opposition to what Hunter initially requested, in respect of the internal workings and management of the then FSB and the cancellations project? Why not apply the same energy and application to tracking down and delivering the assets of the poor/workers as that applied to the assets of the rich and famous?

If Treasury’s approach and activities have been so meaningful, so genuine, so impactful, then why after 24 years of democracy is there such a huge amount of unpaid benefits, which shows no signs of being substantially reduced?

Why has it been so difficult to ensure that the fund managers and financial service providers do their jobs, surely a fairly basic achievement given Treasury’s continual boasts (regardless of more recent turbulence) about its world-class tax gathering and monitoring regime?

Here’s the short answer: Hunter’s indefatigable whistleblower activism (which has come at great personal and financial cost) has surfaced and exposed the lethargy, the de-prioritisation and the buddy-buddy approach of both the Treasury and the FCSA when it comes to outrageously wealthy financial institutions and the billions in unpaid benefits due to so many who have so little.

The reality is that hundreds of thousands (potentially millions) of poor and destitute ex-workers and their families have lost most of their confidence in the integrity and “reputation” of the FCSA and its Treasury parent to perform their functions in a just, equitable and efficient manner, to serve their interests.

Beware Treasury; you are in danger of becoming the institutional embodiment of a 21st century South African Marie Antoinette.

First published here : https://www.dailymaverick.co.za/opinionista/2018-10-24-national-treasury-and-the-financial-services-sector-whose-interests-are-really-being-served/